U.S. Import Prices Rise on Fuel Costs: Inflation Risks Loom

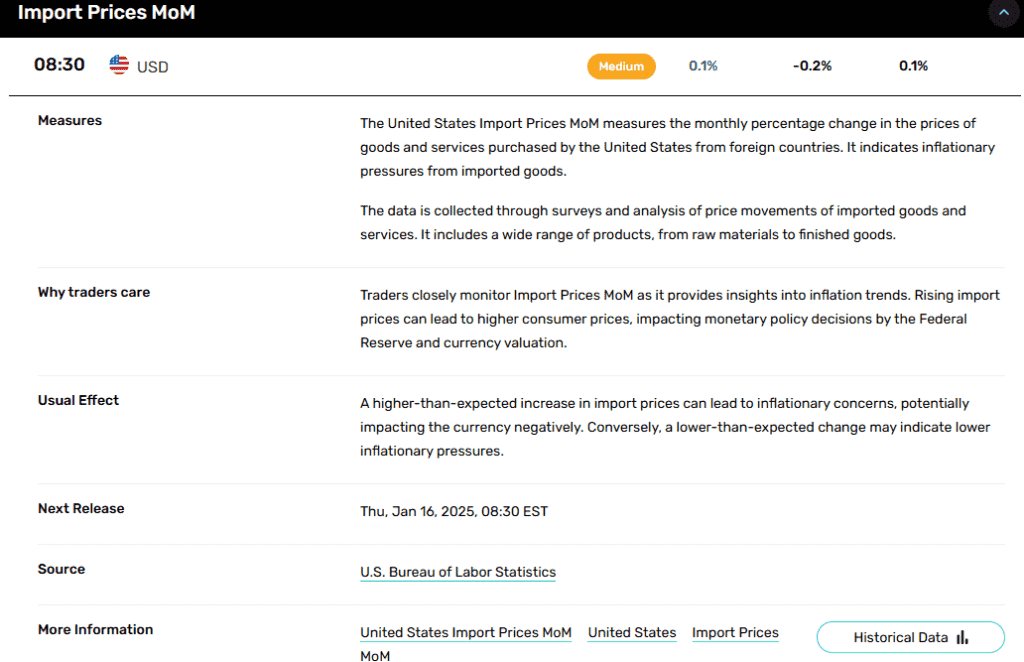

In November 2024, U.S. import prices rose by 0.1%, defying the expectations of a 0.2% decline. This unexpected increase, primarily driven by higher fuel costs, is raising concerns about potential inflationary pressures, complicating the Federal Reserve’s strategy in combating inflation. The rise in import prices marks the second consecutive month of increases, underscoring persistent cost pressures in global trade, particularly in energy markets.

The Fuel Price Impact on Import Costs

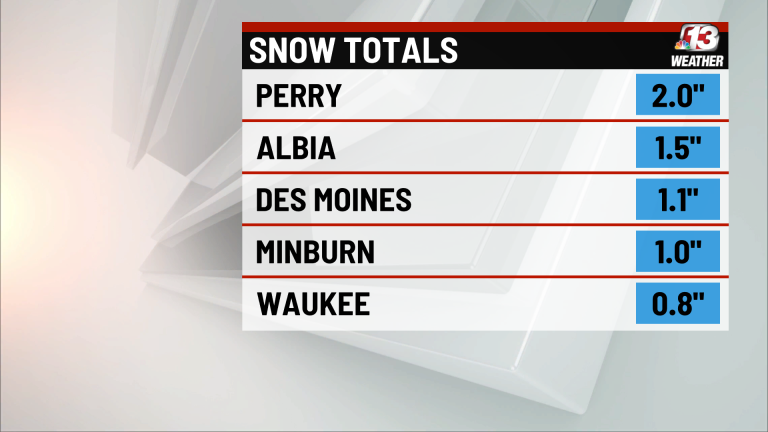

The 0.1% increase in overall U.S. import prices in November was largely attributed to a significant 1.0% rise in fuel prices, particularly natural gas. In fact, natural gas import prices surged 47.4% in November, following a 32.7% jump in October. While these price increases are substantial, they come on the back of a year-over-year decline of 34.5%, indicating the volatility of energy markets.

Despite this, fuel imports remain a source of uncertainty, as the ongoing fluctuations in energy prices create potential risks for inflation. Importantly, fuel prices make up a considerable portion of U.S. import expenditures, meaning that fluctuations here can have ripple effects across various sectors of the economy. The rise in energy prices is especially notable in the context of inflation concerns, as higher fuel costs typically lead to higher production costs, which are passed on to consumers.

While the increase in fuel prices is a primary driver of the rise in import prices, it is worth noting that nonfuel import prices remained relatively stable. Food, feeds, and beverages saw a modest uptick of 1.3%, thanks to a sharp 13.1% increase in vegetable prices. However, these gains were offset by declines in industrial supplies and capital goods, which had a flat overall impact on nonfuel import prices.

The Broader Economic Impact of Rising Import Prices

The latest data on U.S. import prices signals a continued pressure on the economy, particularly in terms of inflation. With fuel costs pushing up import prices, there is concern that this could contribute to a broader rise in consumer prices, putting additional strain on households. This trend is especially worrying for the Federal Reserve, which has been actively tightening monetary policy to control inflation.

The unexpected rise in import prices complicates the Fed’s decision-making process. If higher import prices continue, it could maintain upward pressure on Treasury yields as markets adjust to the inflationary risks. Furthermore, the sustained increase in fuel costs could lead to higher input costs for businesses, impacting profit margins and consumer spending. For the Federal Reserve, this suggests a need to remain vigilant and potentially more aggressive in managing inflation, despite some signs of slowing price growth in other areas of the economy.

U.S. Export Prices and Trade Balance

While import prices were on the rise, export prices remained largely unchanged in November. Agricultural exports, however, saw a modest decline, with prices falling 0.4% due to lower soybean and fruit prices. Nonagricultural export prices, on the other hand, rose slightly by 0.1%, driven by increases in the prices of capital goods and industrial materials.

Regionally, export prices to major trading partners like China and Japan also experienced declines, contributing to a weaker U.S. terms of trade. Export prices to China dropped by 0.5%, while those to Japan fell by 1.0%. These declines in export prices signal challenges for U.S. exporters, as reduced demand from key markets could further weigh on the country’s trade balance and economic growth prospects.

Implications for the Markets

The rise in import prices due to higher fuel costs could have broader implications for financial markets. One area likely to be impacted is the bond market, where the unexpected increase in import prices may push Treasury yields higher. With inflation concerns resurfacing, traders are likely to adjust their expectations for Federal Reserve policy, potentially leading to more tightening or sustained interest rates.

Commodity markets, particularly gold, may not find immediate support from the current inflationary pressures. With a mixed outlook for fuel imports and agricultural exports, investors may be cautious about seeking gold as a safe haven. Additionally, sectors reliant on imported goods—such as consumer products and industrial supplies—could face headwinds. Rising import prices could squeeze profit margins, especially for companies heavily dependent on capital goods and industrial inputs.

Equity markets, particularly in sectors reliant on international trade, may face some uncertainty as import price increases weigh on corporate earnings. The combination of rising import costs and weaker export prices suggests a more challenging environment for global growth and U.S. corporations.

Conclusion: Inflationary Pressures Persist

In summary, the unexpected rise in U.S. import prices in November 2024, driven by higher fuel costs, signals ongoing inflation risks. With energy prices driving cost increases, the Federal Reserve faces continued challenges in managing inflation without derailing economic growth. The mixed performance in export prices and rising import costs may contribute to heightened market volatility, particularly in bond and equity markets. While inflation appears to be moderating in some areas, the persistence of rising fuel costs means that inflationary pressures are likely to remain a key concern for policymakers and markets in the months ahead.

As traders and investors adjust their outlooks in response to these trends, the overall economic environment points to a period of uncertainty, with implications for interest rates, market volatility, and inflation expectations.